April 5, 2022

Most investors like to believe they are solely focused on achieving the best returns. Further, they believe they strive to employ the best ideas to build their optimal portfolio. They also like to think that either their financial advisor or they themselves are making decisions on facts and supporting data to achieve their financial goals, if said goals are to achieve the highest returns with good balance and high liquidity.

This post will not get into the reasons why individual investors and/or their financial advisors make the asset allocation choices they do. We will leave that up to the reader to determine.

Hopefully, what readers take away from the following hard data is that now, maybe more than ever before, it’s time to embrace what’s outside the confines of the mainstream financial media thought box.

Our case will be presented with two simple and straightforward charts:

Q1 2022 Performance – Gold vs Dow, USD and TSY’s

The numbers are the numbers. Regarding the stock market being safer, less volatile, and an investment vehicle always providing better returns then gold, the barbaric relic beat stocks by almost 10%. As for fixed income versus gold, it was a bloodbath with gold outperforming the safest bonds by a whopping 17%.

Of course the returns from just one quarter should not be evidence enough to raise doubts on the conventional wisdom regarding gold investing. Therefore, lets turn to a long-term comparison of gold versus stocks.

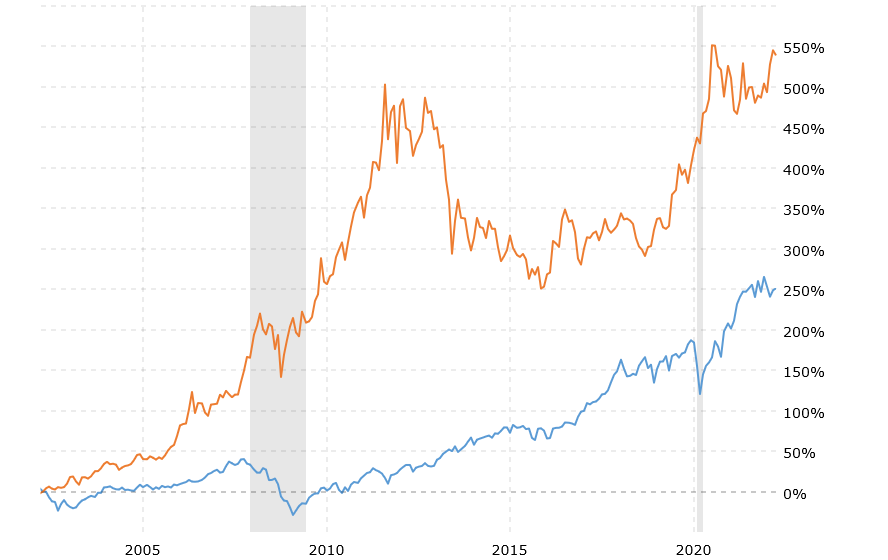

20 Year Performance – Gold Versus Dow

Gold, despite all the misinformation and disinformation spewed by the mainstream financial media and Wall Street “thought leaders” (editors opinion), thoroughly trounced the Dow over this very extended period of time. And unlike the marketing associated with a typical mutual fund, where beating an index by a small amount is loudly crowed about, gold simply blew stocks away without receiving any deserved recognition from mainstream financial pundits.

Bottom line, portfolios holding some real gold benefited big time. The questions to ponder regarding financial advice and prognostications from the mainstream echo chamber are:

- Do they understand gold?

- Are portfolios really being constructed in the best interest of clients?

- Are “conspiracy theories” regarding Wall Street’s anti-gold position actually factual?

- Is it time to allocate a part of one’s portfolio to gold and precious metals?

- Is it smarter to invest in precious metals away from the institutions which meet the descriptions in points 1-3 above?