Where do we land from here?

Gold had a strong 2023, defying expectations amid a high interest rate environment, and outperforming commodities, bonds and most stock markets. As we look forward to 2024 investors will likely see one of three scenarios (Table 1). Market consensus anticipates a ‘soft landing’ in the US, which should also positively affect the global economy. Historically, soft landing environments have not been particularly attractive for gold, resulting in flat to slightly negative returns.

That said, every cycle is different. This time around, heightened geopolitical tensions in a key election year for many major economies, combined with continued central bank buying could provide additional support for gold.

Further, the likelihood of the Fed steering the US economy to a safe landing with interest rates above five percent is by no means certain. And a global recession is still on the cards. This should encourage many investors to hold effective hedges, such as gold, in their portfolios.

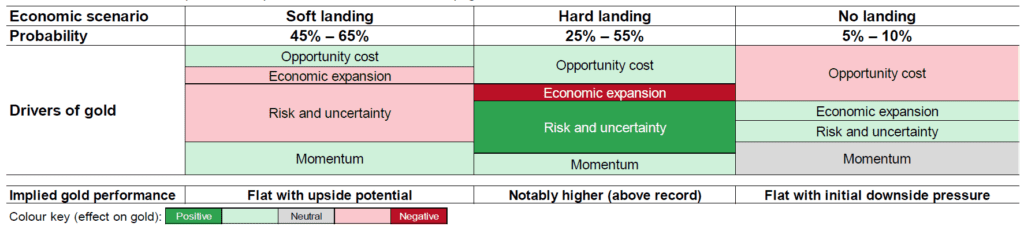

Table 1: The global economy faces three likely scenarios in 2024

Economic scenarios, probability of occurrence and key gold drivers*

*Based on market consensus and other indicators. Size of gold drivers represents relative importance within each scenario. Impact on gold performance based on average annual prices as implied by the Gold Valuation Framework. For more details on variables used as proxies for each driver, see Table 2.

Source: World Gold Council

Read more here:

https://www.gold.org/goldhub/research/gold-outlook-2024