Author:

JOHN RUBINO

De-dollarization events that would once have been a big deal have become common lately. Some examples:

UAE officially stops using dollar for oil trades

(Watcher) – The United Arab Emirates (UAE) is asking BRICS countries to settle oil trade in local currencies and not the U.S. dollar. The Middle Eastern nation is aiming to diversify its economic partnerships by renewing payment methods for oil trade deals. The UAE is approaching China, Russia, India, and Egypt, among other nations to pay local currencies for oil settlement and sideline the U.S. dollar.

According to reports, the UAE is in talks with 15 countries and is promoting local currency payments ending reliance on the U.S. dollar. The realigning of bilateral strategic partnerships could lead to a paradigm shift in the financial approach of BRICS countries. Controlling the global oil sector by ending reliance on the U.S. dollar could make BRICS turn into an economic powerhouse.

China, Saudi Arabia sign currency swap agreement

(Reuters) – The People’s Bank of China and the Saudi Central Bank recently signed a local currency swap agreement worth 50 billion yuan ($6.93 billion) or 26 billion Saudi riyals, both banks said on Monday, as bilateral relations continued to gather momentum.

Saudi Arabia, the world’s top oil exporter, and China, the world’s biggest energy consumer, have worked to take relations beyond hydrocarbon ties in recent years, expanding collaboration into areas such as security and technology.

The swap agreement, which will be valid for three years and can be extended by mutual agreement, “will help strengthen financial cooperation… expand the use of local currencies… and promote trade and investment,” between Riyadh and Beijing, the statement from China’s central bank said.

China imported $65 billion worth of Saudi crude in 2022, according to Chinese customs data, accounting for about 83% of the kingdom’s total exports to the Asian giant.

Russia-China de-dollarization almost complete – deputy PM

(RT) – 95% of trade between the countries is now settled in their national currencies, according to Andrey Belousov

Western currencies have been almost completely phased out in Russia-China trade, as nearly all payments between the countries are now carried out in rubles and yuan, Russian First Deputy Prime Minister Andrey Belousov announced on Monday.

Since the introduction of Western sanctions on Moscow, Russia and China have accelerated the use of their own currencies in trade. According to Belousov, 95% of all transactions between Russia and China are now carried out in one of the countries’ national currencies, and given the rapid expansion of mutual trade and cooperation, this percentage is likely to grow.

Speaking at a meeting of the Russia-China intergovernmental commission in Beijing, the deputy prime minister said bilateral trade between the two countries will exceed the target of $200 billion this year, and may reach $300 billion by 2030.

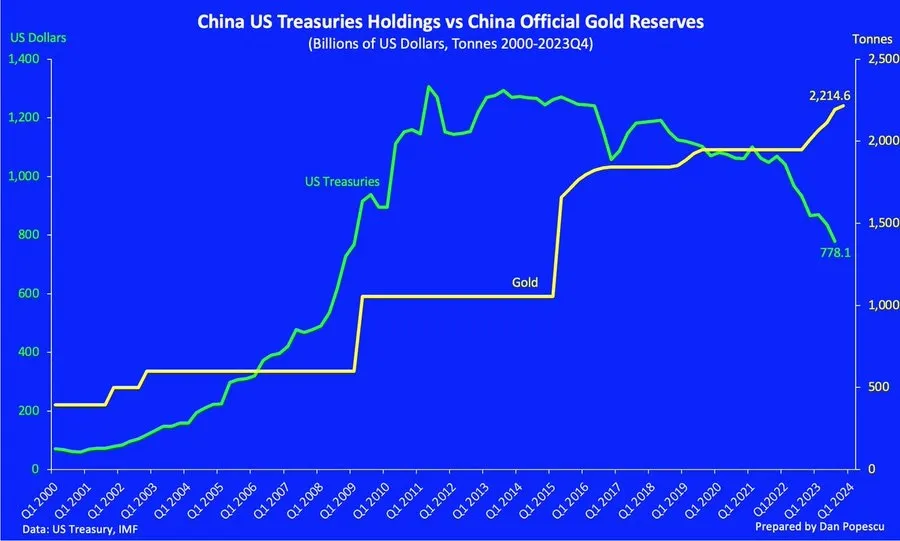

China, meanwhile, has been swapping US Treasury paper for gold at an accelerating rate:

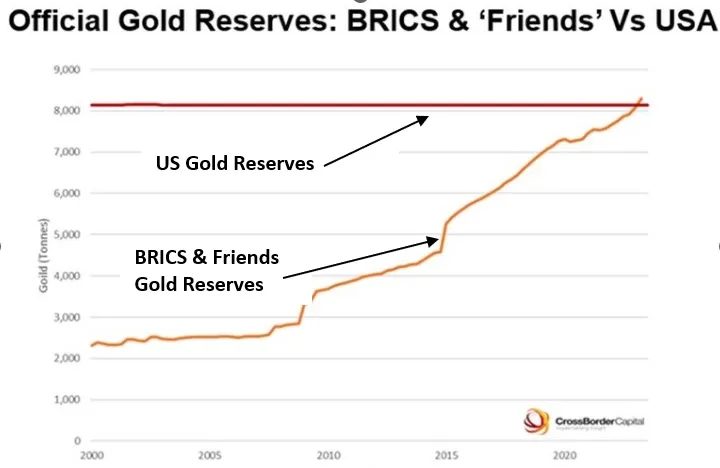

This year, the “BRICS & friends”’ gold reserves surpassed America’s (theoretical) reserves.

And the Chinese are still buying aggressively:

De-dollarization remains an uphill battle

From the Carnegie Endowment:

The Difficult Realities of the BRICS’ Dedollarization Efforts—and the Renminbi’s Role

Unlike the world’s other currencies, the dollar plays a dominant role in cross-border trade and finance across many “third countries” where it is not the official currency. Indeed, for many emerging markets, the dollar is more stable and more commonly accepted as a medium of payment in cross-border trade than the local currency. Exports from and imports to emerging markets, particularly commodities, are often priced in dollars. External debts in these countries are also often denominated and paid in dollars, reflecting belief in the dollar’s future stability and widespread acceptance. Relative to emerging markets’ local currencies, particularly in the context of cross-border trade and finance, the dollar often much more completely fulfills the four functions of money, serving as a widely accepted: (1) medium of exchange; (2) unit of account; (3) store of value; and 4) standard of deferred payment.6

The dollar’s widespread use in these regards is self-reinforcing, preserving its dominant global role and impeding efforts to dedollarize. Although the expanded BRICS bloc would be comprised of countries whose economies together are larger than the U.S. economy, dedollarization efforts will still face major headwinds, in part because of the relatively higher costs and inefficiencies of using many non-dollar currencies in cross-border trade and finance. Across emerging markets, the dollar is still the preeminent medium of cross-border trade and remains integral to financial markets.

Indeed, data from 2022 indicated that the dollar was on one side of the trade for over 97 percent, 95 percent, 94 percent, and 88 percent of Indian rupee, Brazilian real, Chinese renminbi, and South African rand foreign exchange transactions, respectively. Data also indicated that in 2022, globally, the dollar was on one side of the trade for almost 90 percent of all foreign exchange transactions. Currency pairs involving the dollar are generally far more liquid and thus less costly to exchange than emerging market currency pairs. Indeed, no well-functioning markets for directly exchanging many emerging market currency pairs even exist. The dollar is therefore oftentimes used to facilitate exchanges between emerging market currencies. As a result, even when cross-border trade is invoiced in a local currency, the dollar may ultimately play a role in facilitating that transaction.

Michael Pettis, a Carnegie Endowment senior fellow, offers this rebuttal:

[The above article] reflects one (seemingly widespread) confusion about the role of the dollar. It suggests that one of the reasons some countries are considering switching from using dollars to using other currencies is to protect themselves from “dollar shortages”.

In fact “dollar shortages” have nothing to do with dollars. Countries that suffer from dollar shortages, like Argentina, also suffer from euro shortages, sterling shortages, yen shortages and even, in spite of what you might think, renminbi shortages.

That’s because “dollar shortage” is just the name we give for a foreign currency shortage, and a foreign currency shortage is caused not by the use of dollars but rather by an adverse balance of payments position. The huge external debt, high inflation levels, and local hoarding of hard currencies that is the root of Argentina’s dollar shortage would just as certainly create a euro shortage should Argentines decide to “switch” from denominating their debt, reserves and trade in dollars to denominating them in euros.

Let’s end with this video citing multiple sources on the sudden eruption of a new gold bull market: