Author:

JOHN RUBINO

When sales are actually purchases

Central banks have morphed recently from net sellers of gold to increasingly aggressive net buyers. And the buying is even more aggressive than it seems. Here’s the story in three charts:

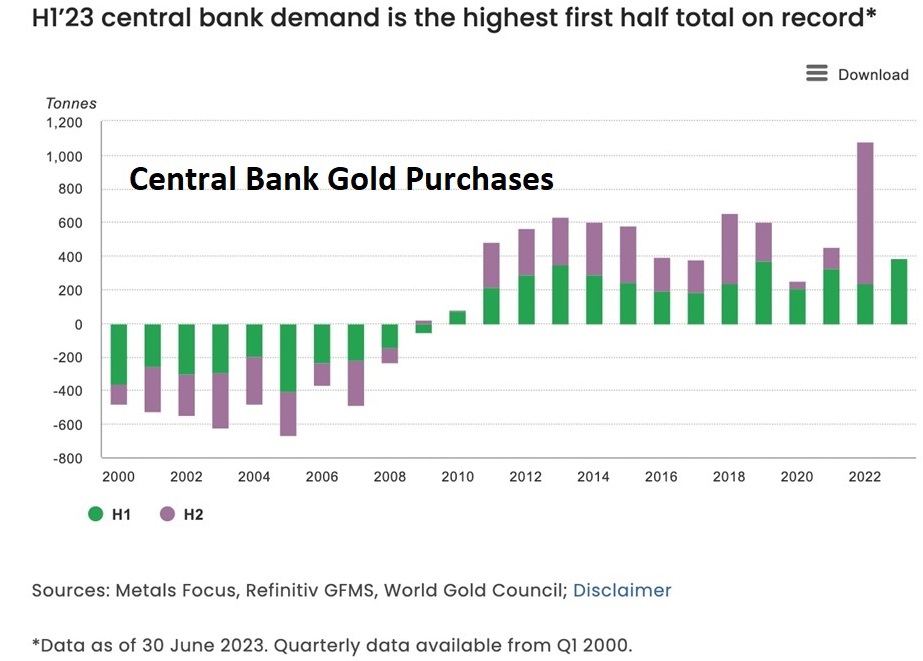

When the global financial system nearly imploded in 2008, central banks stopped selling gold and started buying. To put this buying into context, the world’s mines produce about 3,000 tonnes of gold per year. So 800 tonnes of annual central bank buying, which happened five years out of the past ten, is a significant number.

In 2022 this buying spiked to 1,000 tonnes, worth about $70 billion. And the first half of 2023 was the highest first half on record.

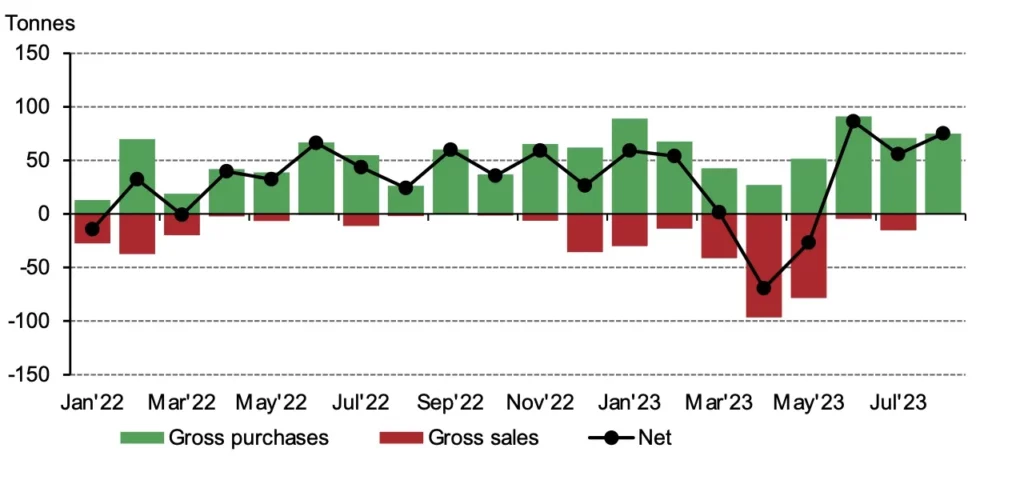

But within that strong first half were some months when central bank selling was disturbingly high.

Is this a sign that central banks are starting to shift back into net-seller mode? Or was it a one-off event for unrelated reasons? Well, it turns out that not only was it a one-off event, it was actually a positive one-off event.

Turkey, which in recent years has been a major gold buyer, was forced to sell off some of its gold reserves because its citizens wanted to buy it:

Turkey is selling off its gold reserves to meet surging domestic demand

(Kitco News) – Turkey’s central bank is offloading its gold reserves to help meet high domestic demand after curbing precious metals imports in February, Bloomberg reported.

Turkey has seen a surge in gold demand in the past year as citizens embraced the precious metal as a hedge against inflation, which ran at a pace of over 85% at one point last year, and local currency devaluation.

The central bank’s data showed that gold reserves fell 9% in the last seven weeks.

Turkey also sold 15 tonnes of gold in March, the World Gold Council reported. This marked the first monthly net sale since November 2021 and lowered the country’s reserves to 572 tonnes.

Turkey’s gold consumption saw a huge jump last year, with the country’s central bank being the top gold buyer.

Turkey’s official gold reserves rose by 148 tonnes to 542 tonnes last year, marking the highest level on record for Turkey, according to the World Gold Council data.

On top of that, Turkey’s gold imports from Switzerland hit the highest level on record in January, totaling 58.3 tonnes worth $3.6 billion.

In February, Turkey introduced steps to curb surging gold imports.

The cut was due to growing gold imports directly contributing to the Turkish current account deficit, which remained significantly negative in February, coming in at $8.78 billion. In January, Turkey saw a record deficit of $10 billion.

To sum up, Turkey’s citizens are doing what people have done since the beginning of recorded history: They’re buying gold in response to a weakening currency. So what looks like big selling by the Turkish central bank is actually a transfer within the country from the bank to its citizens.

Now go back to the above monthly chart and look at central bank purchases for July and August. Once Turkey stopped selling (and started buying again), central banks went back to being aggressive gold accumulators. 2023 is looking like another big year, with August’s pace annualizing to about 900 tonnes. This gives the metal a nice tailwind to go with all the other reasons to be swapping fiat currencies for precious metals.

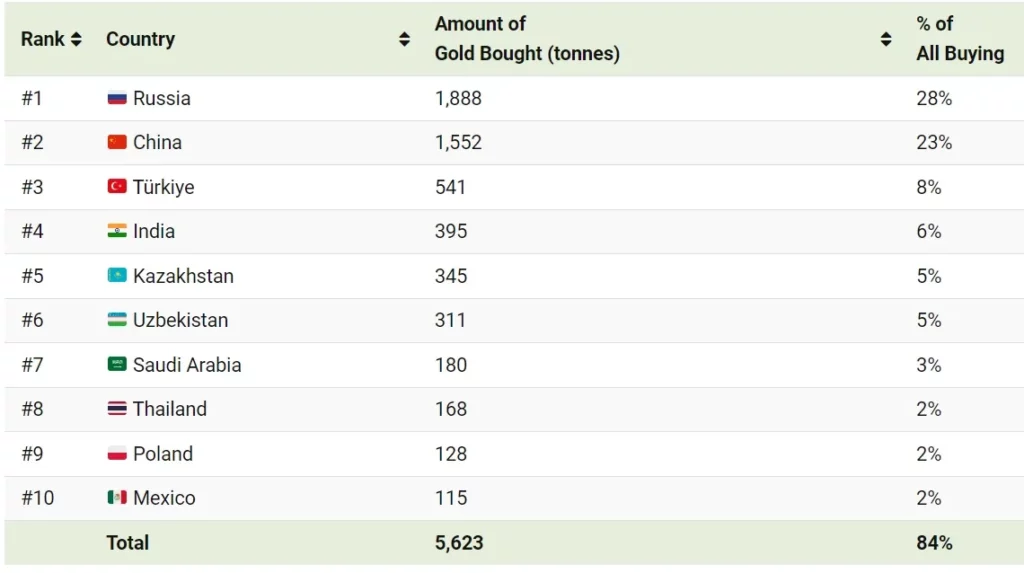

Let’s end with a list of the top ten central bank gold buyers from 1999 to 2021. Note that members of the BRICS+ coalition (now including Saudia Arabia) feature prominently. Presumably, most of these countries are selling US Treasury bonds to finance their gold purchases. So de-dollarization is a big and growing part of the gold story.