And that’s BEFORE the next recession

Author:

JOHN RUBINO

This is the first in what promises to be a long series showing what happens when governments run out of money and start cutting services. California is the obvious place to start.

Huge, diverse … bankrupt?

California has three world-class assets — Hollywood, Silicon Valley, and agriculture — which, in good times, generate enough tax revenue to fund a state budget that dwarfs those of most countries.

And recent times have been good. Budget surpluses allowed Sacramento to fund pretty much everything, including, to its credit, multi-billion dollar rainy day funds. The state, mathematically at least, was a fiscal success story.

Then it all fell apart

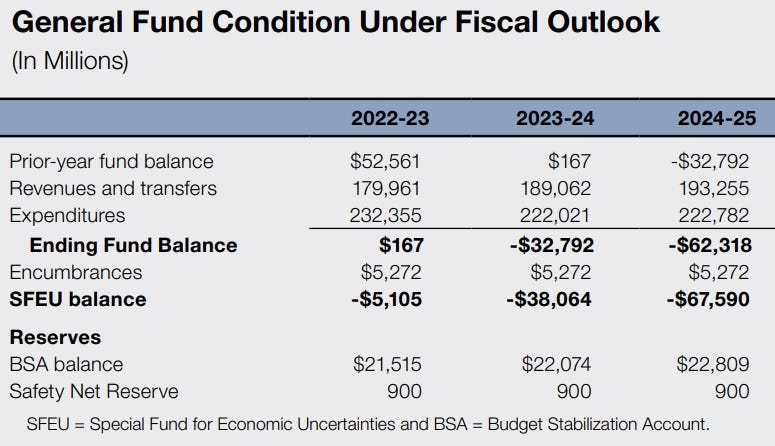

In just the past couple of years, California’s tax revenues have plunged and interest expense has spiked, turning the previously mentioned surplus into a gaping chasm now projected to be $68 billion for the next fiscal year. It’s safe to say without even looking it up that no state has ever faced such a gap between spending and revenue.

What happened?

As the California Legislative Analyst’s Office tells it,

Higher Borrowing Costs and Reduced Investment Have Cooled California’s Economy. In an effort to cool an overheated U.S. economy, the Federal Reserve has taken actions over the last two years to make borrowing more expensive and reduce the amount of money available for investment. This has slowed economic activity in a number of ways. For example, home sales are down by about half, largely because the monthly mortgage to purchase a typical California home has gone from $3,500 to $5,400.

Some effects of the Federal Reserve’s actions have hit segments of the economy that have an outsized importance to California. In particular, investment in California startups and technology companies is especially sensitive to financial conditions and, as a result, has dropped significantly. For example, the number of California companies that went public (sold stock to public investors for the first time) in 2022 and 2023 is down over 80 percent from 2021. As a result, California businesses have had much less funding available to expand operations or hire new workers.

State’s Economy Entered a Downturn in 2022. These mounting economic headwinds have pushed the state’s economy into a downturn. The number of unemployed workers in California has risen nearly 200,000 since the summer of 2022. This has resulted in a jump in the state’s unemployment rate from 3.8 percent to 4.8 percent. Similarly, inflation-adjusted incomes posted five straight quarters of year-over-year declines from the first quarter of 2022 to the first quarter 2023.

Revenues Are Lower Than Budget Act Projections by $58 Billion. As described earlier, collections data to date show a severe revenue decline, with total income tax collections down 25 percent in 2022-23.

States, unlike the federal government, can’t just create new currency to paper over their mistakes. So they have to at least pretend to run balanced budgets. Which in turn means they actually have to do things when a surprise deficit jumps up and bites them. In California’s case, the menu includes:

- Spend its $24 billion of reserves.

- Reduce funding for schools and community colleges.

- Shift maintenance projects into future years, thus delaying the date of payment.

- Delay raises and pension increases for state employees.

Here’s how it starts:

But then what?

If this seems like a bunch of stop-gap measures designed for a single-year emergency, that’s because they are. Running through reserves is analogous to emptying a savings account to pay for Christmas presents while moving pay raises and road repairs from one year to the next is more like maxing out a credit card. Either way, they aren’t sustainable and there are no more tricks up the governor’s sleeve for future deficits.

And future deficits are definitely coming, as structural problems (spiking credit card, mortgage, and student debt, for instance, see here and here) make 2024 a much harder year for the country as a whole than mainstream economists seem to expect.

So imagine a 2025 in which California’s rainy day funds are gone and spending is still way too high. The only solution is real spending cuts like layoffs and program cancellations, resulting in fewer teachers, cops, and firefighters, deteriorating infrastructure, shorter library hours, etc. And of course much higher taxes, which will be a big part of any balanced-budget compromise.

Turbo-charged exodus

This budget crisis and the proposed fixes come at a time when Californians’ quality of life is already cratering. The homeless encampments (27% of the country’s homeless are in this one state), boarded-up downtowns, brazen crime, and falling commercial real estate prices are already front-page news, as is the massive and growing exodus of taxpayers and businesses.

So the above service cuts and tax increases will fall on a populace that’s already wondering about greener pastures. An even bigger part of the tax base will leave, making a balanced budget impossible without even more draconian service cuts.

And so on, producing a classic financial death spiral in which fixing current problems makes future problems insurmountable until, well, the end, whatever that turns out to be.