Demand is cratering for houses, trucks, toys, you name it

Author:

JOHN RUBINO

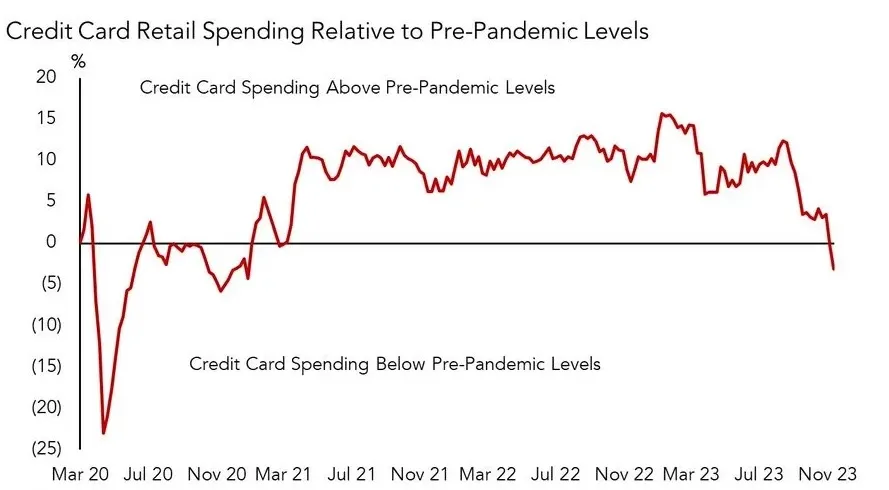

Americans have spent the past few years putting ever-bigger parts of their day-to-day lives on plastic. And now the stats are brutal: Total credit card debt recently pierced $1 trillion while personal interest expense has gone parabolic.

Credit card usage, as a result, has dropped back below pre-pandemic levels:

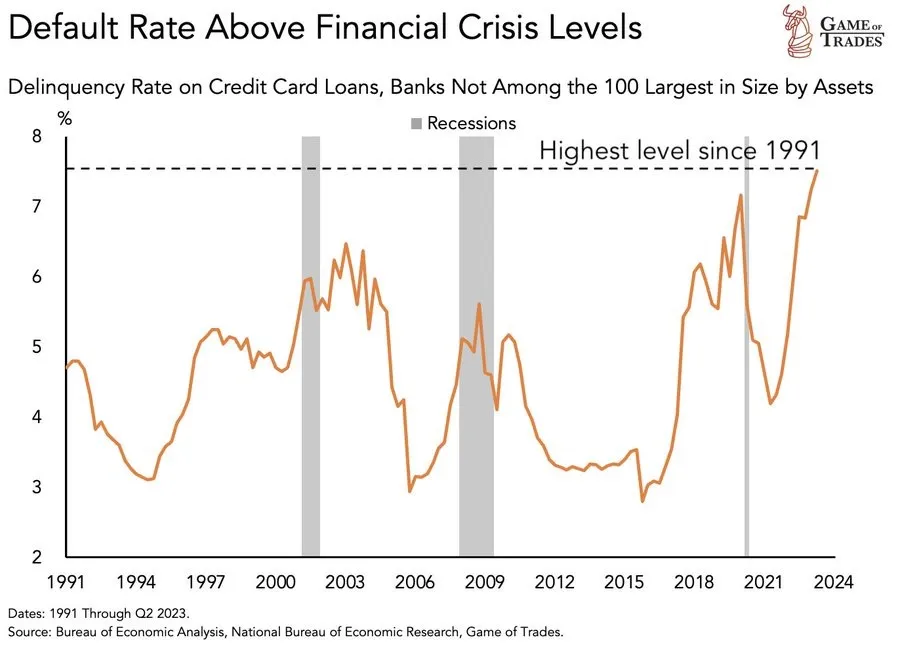

Meanwhile, default rates on credit cards are soaring:

Here’s one example of what the end of casual plastic means:

Hasbro laying off 1,100 workers as weak toy sales persist into holiday season

(CNBC) – Hasbro is laying off about 1,100 employees as the toy maker struggles with soft sales that have carried into the holiday shopping season, according to a company memo obtained by CNBC.

Hasbro had about 6,300 employees as of earlier this year, according to a company fact sheet.

Hasbro, which already laid off hundreds of employees earlier this year, had warned in October that trouble was on the horizon. In the company’s most recent quarterly earnings report, Hasbro slashed its already-soft full-year outlook, projecting a 13% to 15% revenue decline for the year.

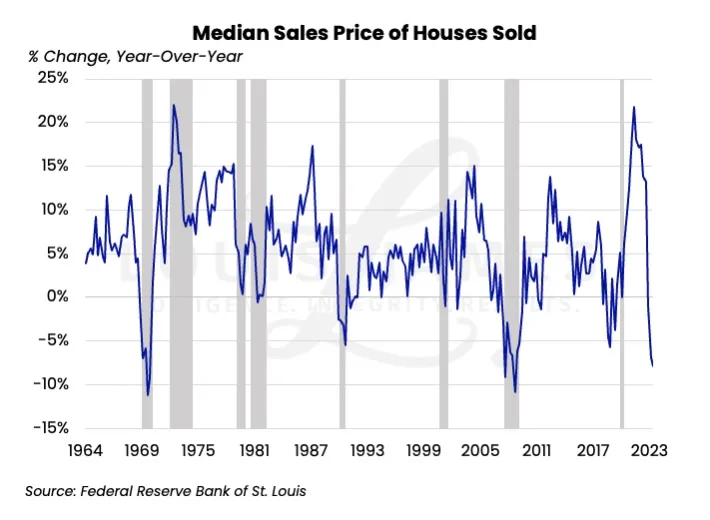

If we can’t afford toys, forget about houses:

Pending home sales drop to a record low, even worse than during the financial crisis

(CNBC) – Pending home sales, a measure of signed contracts on existing homes, dropped 1.5% in October from September.

They hit the lowest level since the National Association of Realtors began tracking this metric in 2001, meaning it’s even worse than readings during the financial crisis more than a decade ago. Sales were down 8.5% from October of last year.

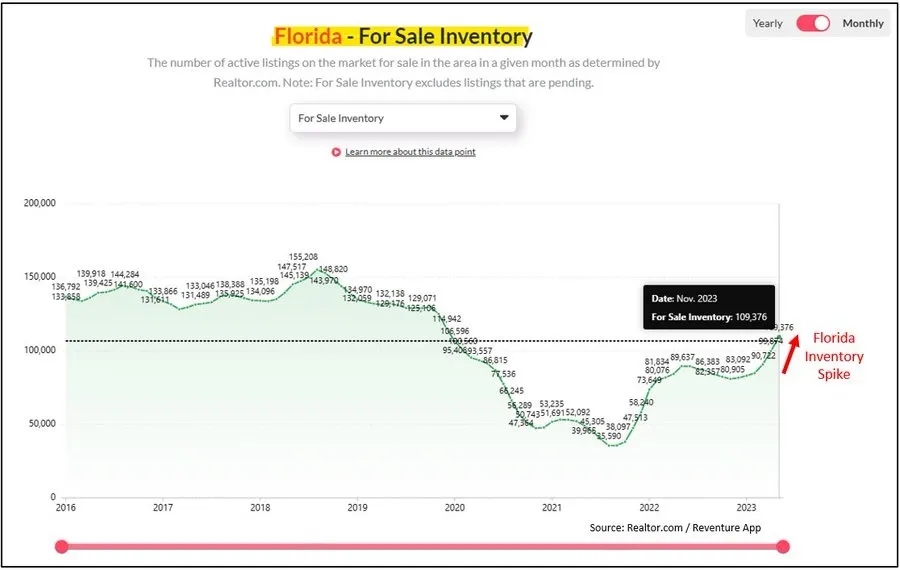

Now comes the “soaring inventory, cratering prices” part of the story:

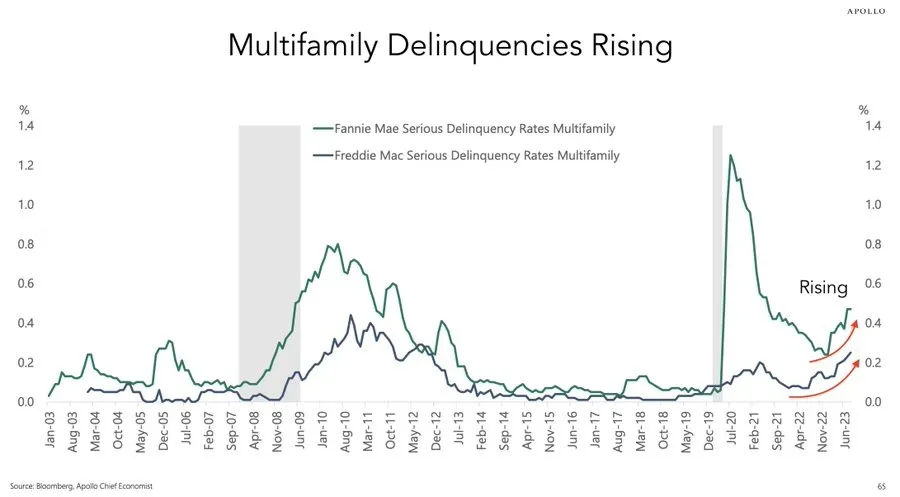

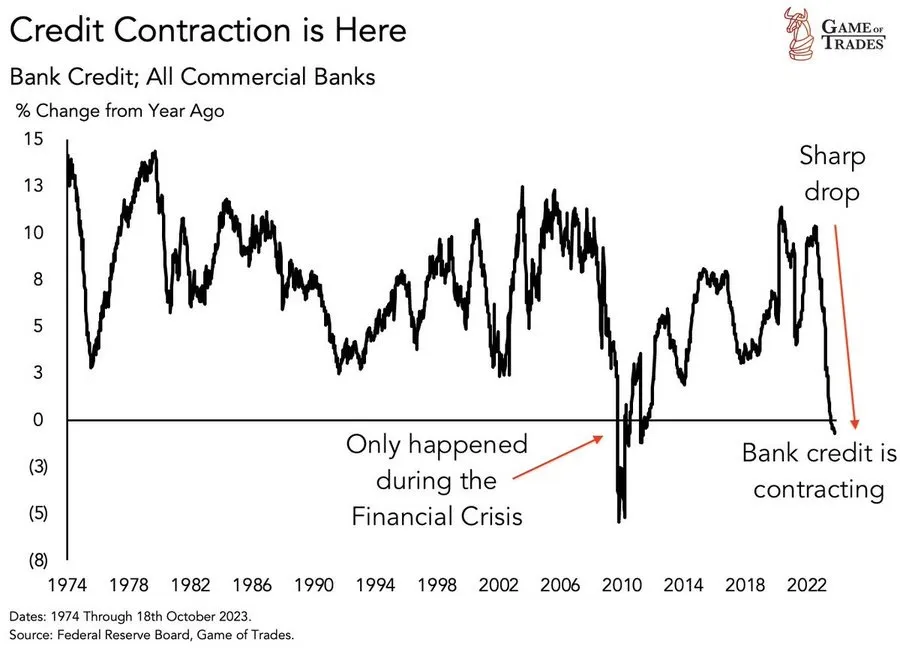

Banks are aware of this and are in no hurry to lend to less-than-stellar borrowers (thanks to Game of Trades for some excellent charts):

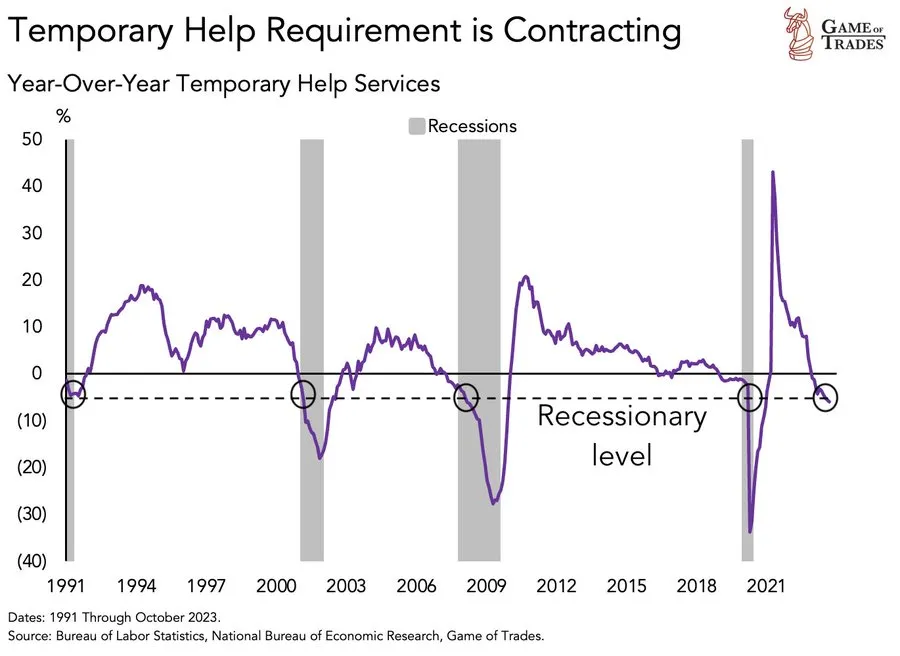

Then there are the myriad obscure-but-telling indicators like “demand for temporary help”:

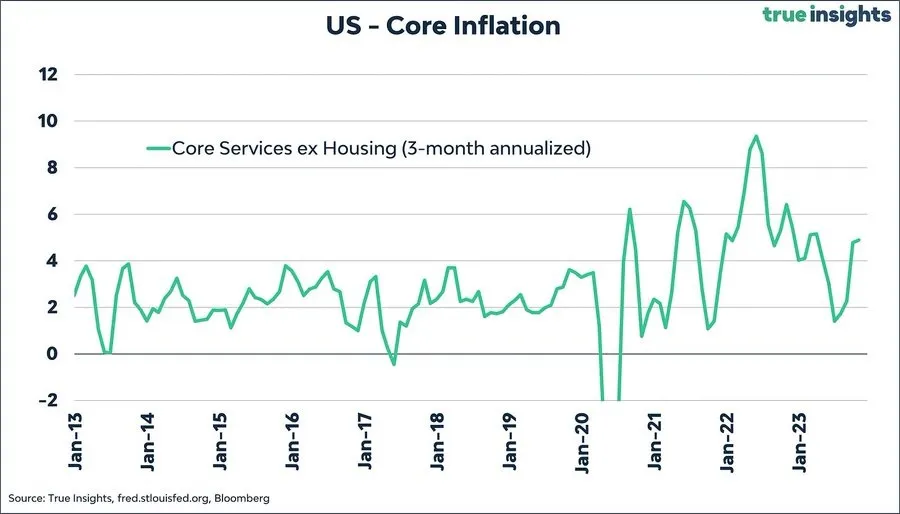

And the Fed can’t ride to the rescue while some measures of core inflation remain above 4%:

As always, YouTube features tons of videos with on-the-ground takes on various sectors. Here’s one on truck demand (imploding)…

… and one on home prices (beginning their long cyclical decline):

Look out below

There’s nothing mysterious about rising debt and soaring prices causing a nasty recession. That’s how it always works, and the prospect only seems extreme because it’s been so long since the last time.

So — using the past as our guide — expect a year of layoffs, bankruptcies, falling prices, and general shock and panic, followed by a government bailout of everything in sight. If you’re in the market for a car or a house (or pretty much anything else including high-quality equities), target the second half of 2024 and don’t hesitate to make low-ball bids. You’ll be amazed at how they pay off.