February 22, 2022 – The escalating tension between Russia and Ukraine is roiling global markets across the board. Equity markets are pointing to this geopolitical situation as today’s reason for stocks continuing their 2022 decline. Conversely, commodity markets are adding to their already robust gains this year, as Russia is one of the largest suppliers of commodities globally.

The implementation of sanctions against Russian is under consideration by a coalition of Western nations. The specifics around sanctions have not yet been fully disclosed. Traders are watching closely as to how proposed sanctions manifest themselves, and the impact they will have on markets. The risk of sanctions proving to be counterproductive is real. It has been reported for years that Russia has been preparing itself to function while being aggressively sanctioned. The potential risk for the world is that commodity prices could escalate dramatically from a standoff between Russia and the West. A material rise in the cost of base commodities and energy would further inflame inflation globally and risk crushing economies worldwide. Such a scenario could prove to produce greater pain for the world at large versus the sanctioned nation.

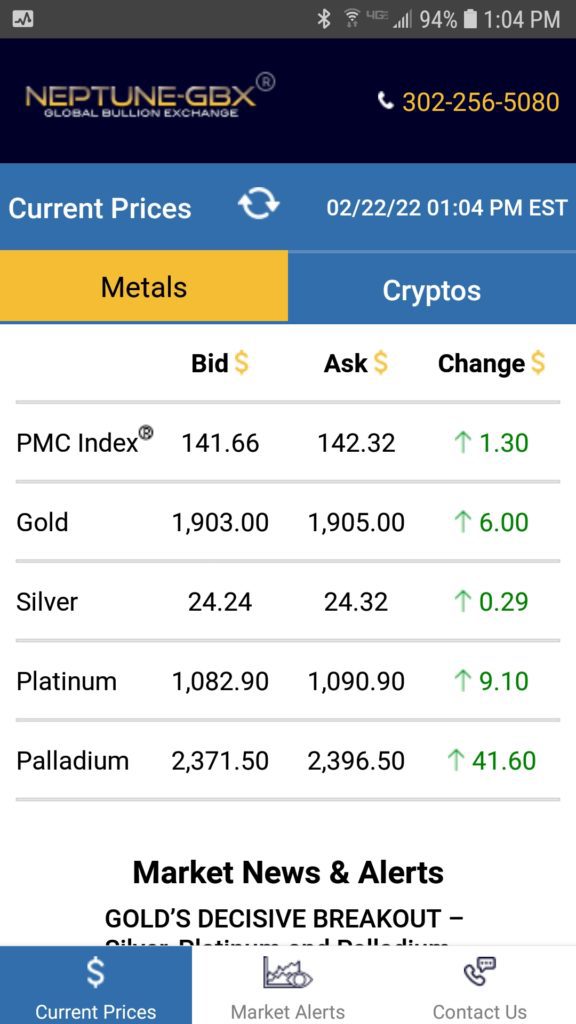

A snapshot of today’s action in the precious metals market is captured below.