March 2, 2022 – Following a powerful move through $1,900, gold eased a bit early Wednesday and is now trading around $1,930 per ounce. Front-month silver futures advanced 4.8% Tuesday to $25.54 an ounce on Comex and is up 6.4% so far this week. Silver surged 8.8% in February after dropping 4.1% in January. It fell 12% in 2021.

The big show in the precious metals complex is palladium. Palladium continues to climb as a result of the worsening situation in the Ukraine. As of this morning, palladium is extending its seven-month rally and trades around $2,640 per ounce.

Adding to the already difficult supply chain issues for the automotive sector, Russia produces about 40% of the world’s palladium, and the metal’s primary use is in catalytic converters for gasoline-powered vehicles. Should the supply of palladium from Russia be curtailed, expect more pain in the auto market and shortages of finished product.

Following a price drop of 22% in 2021, palladium rallied 24% in January and 5.3% in February of 2022. In just the couple of trading days this month, palladium has already jumped 5.2%.

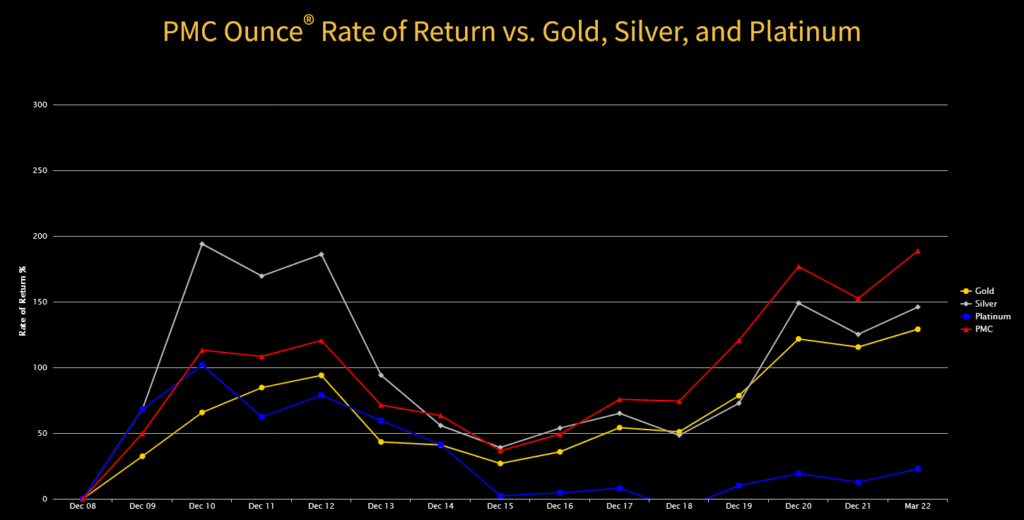

The material impact palladium is having on the precious metals complex is registered and visualized via the PMC Index® – see chart below. The PMC Index® and its companion investment product PMC Ounce® are tracking and capturing the incremental gains provided by the palladium rally. Note that the chart below is showing the performance as of Tuesday’s close.