With the price of gold and silver soaring, particularly in euro terms, many are beginning to wonder if a loss of confidence after yesterday’s Swiss fiasco has started a run on gold? Whatever the case may be, the following piece takes a trip down the rabbit hole of government and central bank lies, manipulation, loss of confidence, and eventual panic.

By John Hathaway

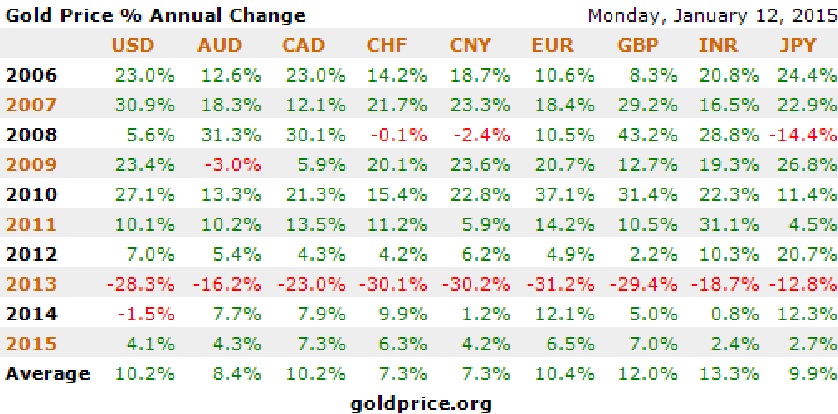

January 16 (King World News) – It is a little-known fact that gold outperformed all currencies in 2014, except for the US dollar. In dollar terms gold declined 1.7 percent, but as the table below shows, it posted solid gains against all other currencies. While the dollar price of gold was essentially flat in 2014, highly negative media coverage created the impression that gold was a disaster. Negative sentiment weighed heavily on the performance of gold-mining shares, with our benchmark XAU index down 17.3 percent.

Meanwhile, dollar bulls appear dangerously overcommitted to the greenback, with open interest at an all-time high. The dollar’s strength relative to other currencies has camouflaged the strength of gold. Both dollar and gold strength in our opinion portend trouble ahead for financial assets (click here). It seems to us that with financial assets at all-time highs and red flags proliferating, this is an opportune moment to acquire cheap wealth insurance in the form of physical metal and precious- metal mining shares.

Continue reading at King World News