March 31, 2022

For over two decades, numerous financial commentators have predicted the US Dollar status as global reserve currency would eventually diminish then end. While this position was dismissed by most in the mainstream financial media and academia, it should not be shocking since all past reserve currencies were eventually displaced.

The abuses, manipulations, and chicanery that issuers of reserve currencies all succumb to is what inevitably bring about their demise. It’s simply an example of the adage; power corrupts and absolute power corrupts absolutely.

It appears that now is a meaningful inflection point for the US Dollar. Unintended (?) consequences from the sanctions imposed on Russia for the Ukraine war are coming to the surface. While the Western nations joined in supporting devastating financial sanctions against Russia, much of the world refused to go along. The push-back by these growing and high population countries, such as China, India, and Brazil, to be part of the economic war against Russia is likely to weaken the USD’s status when all is said and done. This potential status change for the US Dollar would manifest very negative implications for US consumers, markets, government’s ability to issue cheap debt, and USD denominated investments.

Matthew Piepenburg offers his overview and analysis of this situation in the following piece which appeared in Zero Hedge:

How The West Was Lost: A Faltering World Reserve Currency

The Western financial system and world reserve currency is now in open decline.

From Rigged to Fail to Just Plain Failing

Just two years ago, I wrote a book warning that Western markets in general, and US markets in particular, were Rigged to Fail.

Well, now, in real time, they are failing.

This hard reality has less to do with COVID or the war in the Ukraine and more to do with one simple force, which euphoric markets and clueless leaders have been ignoring for decades, namely: Debt.

As I wrote then, and will repeat now: Debt destroys nations, financial systems, markets, and currencies.

Always and every time.

As we see below, the inflationary financial system is now failing because its debt levels have rendered it impotent to grow economically, react sensibly or sustain its chronic debt addictions naturally.

The evidence of this is literally everywhere, from the Fed to the Petrodollar and the bond market to the gold price.

Let’s dig in.

The Fed: No Best-Case Scenarios Left

The Fed has driven itself, and hence the U.S. markets and economy, into an all-too predictable corner and historically dangerous crossroads.

If it turns to the left (i.e., more money printing/liquidity) to protect a record-breaking risk asset bubble, it faces an inflationary flood; if it turns to the right (and raises rates or tapers UST purchases), it faces a market inferno.

How did we get to this crossroads?

Easy: Decades of artificially suppressed rates, cheap credit and a $30T sovereign debt pile of unprecedented (and unsustainable) proportions.

The Dying Bond Bull

With so much of this unloved debt on its national back, no one but the Fed will buy Uncle Sam’s IOUs.

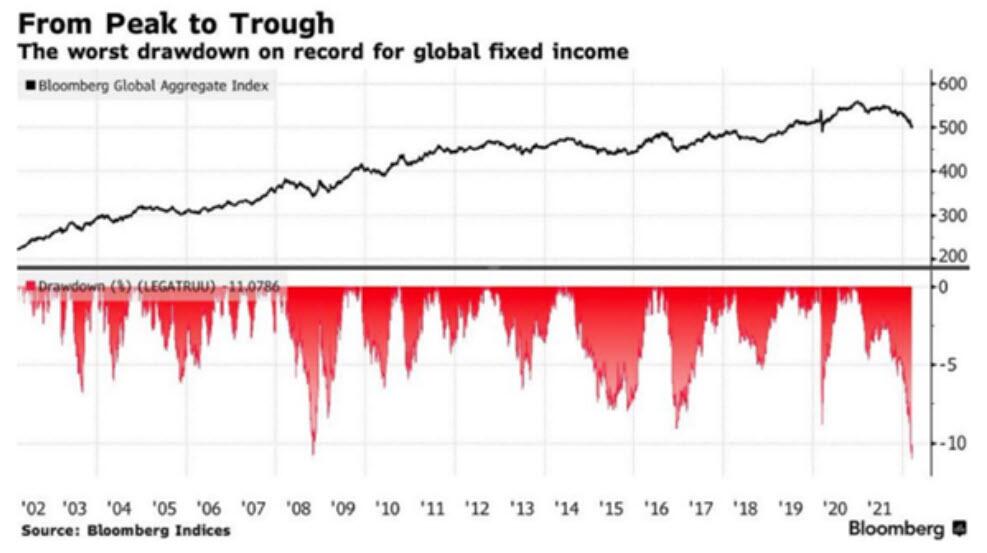

As a result, long-dated Treasuries are falling in price and rising in yield as Bloomberg reminds us of the worst drawdown for global bonds in 20 years.

In short, the central-bank created bond bull of the last 40-something years is now falling to its knees.

Ironically, the only path to more demand for otherwise unloved bonds is if the stock market fully tanks and stock investors flee blindly back into bonds like passengers looking for lifeboats on the Titanic.

Bonds & Stocks—They Can Fall Together Unless Saved by Debased Dollars

But as the “Covid crash” of March 2020 painfully reminded us, in a world of central-bank-driven bubbles, historically over-valued stocks and bonds can and will fall together unless the Fed creates yet another multi-trillion-dollar QE lifeboat, which just kills the inherent strength of the dollar in your wallet.

Hence and again: There’s no good options left. It’s either inflation or a market implosion.

Fantasy & Dishonesty—The New Policy

But this never stops the Fed from pretending otherwise or using words rather than growth to cover its monetary sins.

Despite almost a year of deliberately lying about “transitory inflation,” the Fed has swallowed what little pride it has left and admitted to a real inflationary problem at home.

In short, and as bond legend Mohamed El-Erian recently observed, the increasingly discredited Fed has no “best case” scenarios left.

The Fed, along with its economically clue-less politicians, have essentially devolved the once-great US of A from developed country into one that resembles a developing country.

In other words, the “American dream” as well as American exceptionalism, is being downgraded into a kind of tragi-comedy in real time—i.e., right now.

Nevertheless, the always double-speaking Powell is doubling down on more fantasy (lies) about rising US labor participation and growth to help “produce” the USA out of the debt and inflationary hole which the Greenspan shovel initiated many “exuberant” years ago.

But once again, Powell is wrong.

Labor Participation—The Latest Fantasy

Based on simple demographics, lack of love for US IOU’s, growing trade deficits (alongside rising deficit spending), and an over-priced USD, the US labor force participation will not be going up in time for the land of the world’s reserve currency to grow itself out of the 122% debt to GDP corner which the Fed has driven into (after decades of low-rate drunk driving).

Without increased labor force participation, the only DC option left to fight inflation is to either 1) raise rates to induce a killer recession (and market implosion) or else 2) slash government deficits by at least 10%.

Unfortunately, cutting deficits by 10% will also kill GDP by at least an equivalent amount, which weakens tax receipts and thus make it nearly impossible for Uncle Sam to pay even the interest alone on his national bar tab, as we’ve shown elsewhere.

Addicts Are Predictable Creatures

So, what will this cornered and debt-drunk Fed do?

Well, what all addicts do—keep drinking—i.e., printing ever-more increasingly debased USD’s—which just creates more tailwinds for, you guessed it: Gold. (But also hard asset commodities in general, industrial equities and agricultural real estate.)

In the meantime, the Fed, the US Government and its corporate-owned propaganda arms in the U.S. media will blame all this new money printing and continued deficit spending on Putin rather than decades of financial mismanagement out of DC.

No shocker there.

But Putin, even if you hate him, sees things the headlines are omitting.

De-Dollarization and Petrodollar Rumblings—Uh Oh?

There are increasing signs of “uh-oh” in the world of the once-mighty Petrodollar.

From Trigger Happy to Shot in the Foot

As we’ve been warning in our most recent reports, Western financial sanctions in response to the war in Ukraine have a way of doing as much damage to the trigger-puller as to the intended target.

In simplest terms, freezing one county’s FX reserves and SWIFT transactions has a way of frightening other counter-parties, and not just the intended targets.

Imagine, for example, if your bank accounts were frozen for any reason. Would you then trust the bank that froze your accounts down the road once the issue was resolved? Would you recommend that bank to others?

Well, the world has been watching Western powers effectively freeze Putin’s assets, and regardless of whether you agree or disagree with such measures, other countries (not all of which are “bad actors”) are thinking about switching banks—or at least dollars…

If so, the US has just shot itself in the foot while aiming for Putin.

As previously warned, the Western sanctions are simply pushing Russia and China further together and further away from US Dollars and US Treasuries.

Such shifts have massive ripple effects which Biden’s financial team appears to have ignored.

And as everyone from Jamie Dimon to Barack Obama has previously warned, that’s not a good thing and is causing the broader world to re-think US financial leadership and US Dollar hegemony as a world reserve currency.

Saudi Arabia: Re-Thinking the Petro-Dollar?

Take that not-so-democratic “ally” of the US, Saudi Arabia, who Biden had called a “Pariah State” in 2020…

As of March, the news out of Saudi is hinting that they would consider purchases of oil in CNY as opposed to USD, which would signal the slow end to the Petrodollar and only add more inflationary tailwinds to Americans suffering at home.

One simply cannot underestimate (nor over-state enough) the profound significance of a weakening Petrodollar world.

It would have devastating consequences for the USD and inflation, and would be an absolute boon for gold.

Already, Xi is making plans to negotiate with Saudi Arabia, which is China’s top oil supplier. Meanwhile, Aramco is reaching out to China as well.

What Can Saudi Do with Chinese Money?

Some are arguing that the Saudi’s can’t purchase much with CNY. After all, the USD has more appeal, right?

Hmmm.

Considering the fact that US Treasuries offer zero to negative real yields, perhaps “all things American” just aren’t what they used to be…

Saudis have now seen that the US is willing to seize US Treasuries as a form of financial warfare.

Saudis (like many other nations—i.e., India and China) are certainly asking themselves if a similar move could be made against them in the future.

Thus, it’s no coincidence that they too are looking East rather than West for future deals, and Russia could use its new Chinese currencies to buy everything from nuclear plants to gold bars in Shanghai—just saying…

Oil Matters

Meanwhile, and despite the media’s attempt to paint Putin as Hitler 2.0, the Russian leader knows something the headlines are ignoring, namely: The world needs his oil.

Without Russian oil, the global energy and economic system implodes, because the system has too much debt to suddenly go it alone and/or fight back.

See how sovereign debt cripples options and changes the global stage?

Meanwhile Russia, which doesn’t have the same debt to GDP chains around its ankle as the EU and US, can start demanding payment for its oil in RUB rather than USD.

As of this writing, Arab states are in private discussions with China, Russia and France to stop selling oil in USD.

Such moves would weaken USD demand and strength, adding more inflationary fuel to a growing inflationary fire from Malibu to Manhattan.

I wonder if Biden, Harris or anyone in their circle of “experts” thought that part through?

Given their strength in optics vs. their weakness as to math, geography and history, it’s quite clear they did not and could not…

Not to Worry?

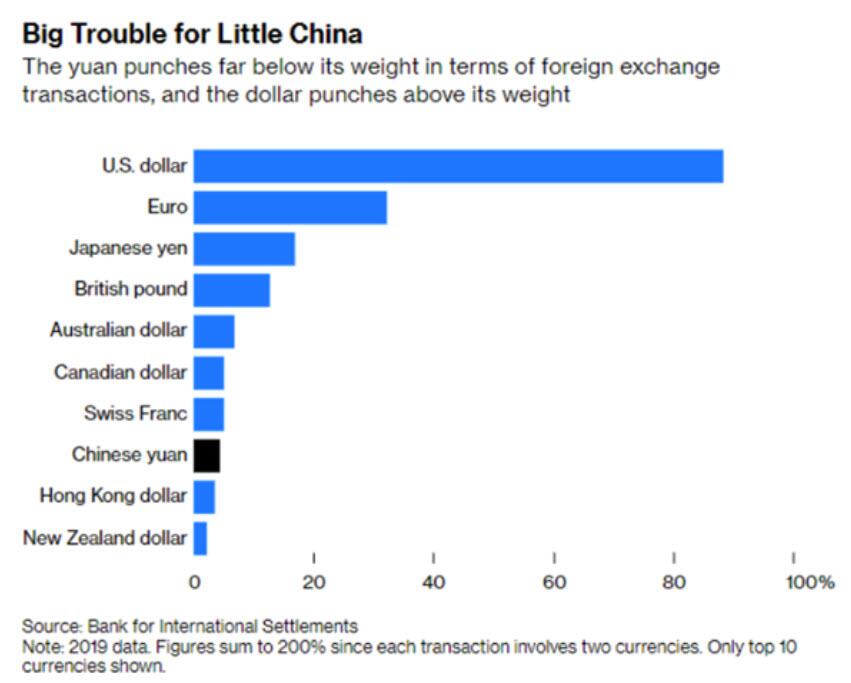

Meanwhile, of course, the WSJ and other Western political news organizations are assuring the world not to worry, as USD FX trading volumes dwarf those of Chinese (Russian) and other currencies.

Fair enough.

But for how long?

Again, what many politicians and most journalists don’t understand (besides basic math), is basic history.

Their myopic policies and smooth-tongued forecasts are based on the notion that if it’s not raining today, it can’t rain tomorrow.

But it’s already raining on the US as well as US global financial leadership.

Meanwhile, Russia’s central bank is now in motion to increase gold purchases with all the new RUBs (not USDs) it will be receiving from its oil sales.

Investors must track these macro events very carefully in the coming weeks and months.

A Multi-Currency New World

The bottom line, however, is that the world is slowly moving away from a one-world-reserve-currency era to an increasingly multi-currency system.

Once the sanction and financial war genie is out of the bottle, it’s hard to put back. Trust in the West, and its USD-led currency system, is changing.

By taking the chest-puffing decision to freeze Russian FX reserves, sanction Russian IMF SDR’s and remove its access to SWIFT payments systems, the US garnered short-term headlines to appear “tough” but ushered a path toward longer term consequences which will make it (and its Dollar) weaker.

As multi-currency oil becomes the new setting, the inflationary winners will, again, be commodities, industrials and certain real estate plays.

Gold Matters

As for gold, it remains the only true neutral reserve asset of global central bank balance sheets and is poised to benefit the most over time as a non-USD denominated energy market slowly emerges.

Furthermore, Russia is allowing payments in gold for its natural gas.

And for those (i.e., Wall Street) who still argue gold is a “pet rock” and “barbarous relic” of the past, it may be time to rethink.

After all, why has the Treasury Department included an entire section in its Russian sanction handbook on gold?

The answer is as obvious as it is ignored.

Chinese banks (with Russian currency swap lines) can act as intermediaries to help Russia use the gold market to “launder” its sanctioned money.

That is, Russia can and will continue to trade globally (Eurasia, Brazil, India, China…) in what boils down to a truly free market of “gold for commodities” which not even those thieves at the COMEX can artificially price fix—something not seen in decades.

De-Globalization

Stated simply: The mighty dollar and “globalization” dreams of the West are slowly witnessing an emerging era of inflationary de-globalization as each country now does what is required and best for itself rather than Klaus Schwab’s megalomaniacal fantasies.

The cornered US, of course, will likely try to sanction gold transactions with Russia, but this would require fully choking Russia energy sales to the EU, which the EU economy (and citizens) simply can’t afford.

In the meantime, a desperate French president is considering stimulus checks for gas and food. That, by the way, is inflationary…

History Repeating Itself

Again, the debt-soaked, energy-dependent West is not as strong as the headlines would have you believe, which means gold, as it has done for thousands of years, will rise as failed leaders, debt-soaked nations and world reserve currencies fall.

History, alas, is as important as math, price-discovery and supply and demand. Sadly, the vast of majority of modern leaders know almost nothing of these forces or topics.

If gold could speak in words, it would simply say: “Shame on them.”

But gold does speak in value, and it’s getting the last laugh on the currencies now weakening in our wallets and the debt-drunk leaders now squawking in our headlines.