April 18, 2022

From ZeroHedge:

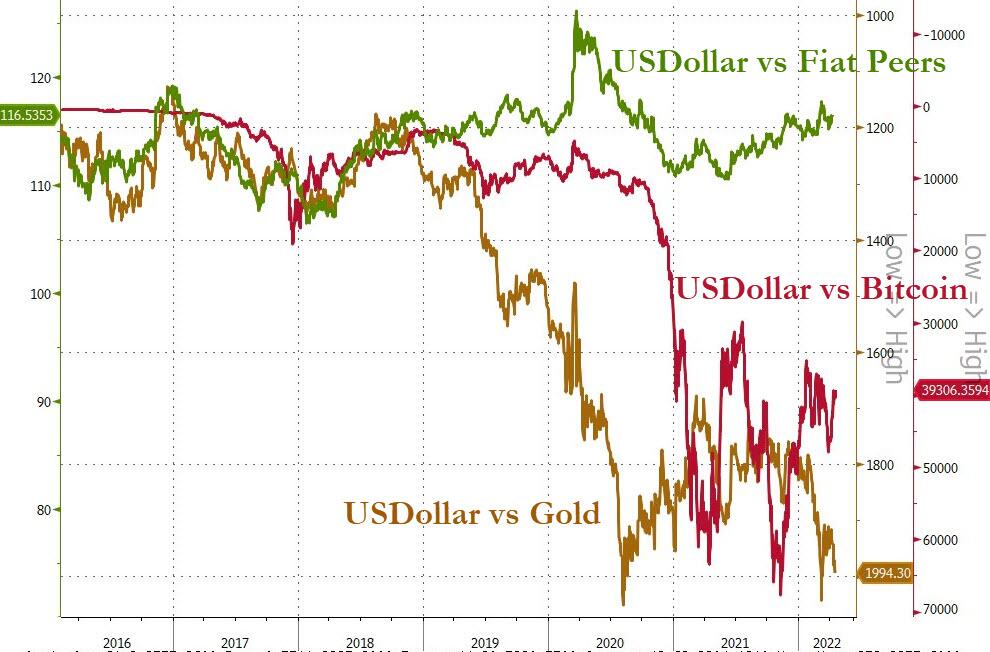

Since the beginning of the year, gold has surge over 9%, topping $2000 again this morning amid geopolitical crises and global stagflation fears…

At the same time, cryptocurrencies have suffered with Bitcoin down around 15% (back below $40,000 this morning), with the most aggressive shift from ‘digital gold’ to ‘real gold’ occurring since Putin invaded Ukraine…

The barbarous relic’s besting of bitcoin has may questioning the latter’s ‘inflation-hedge’ status:

“It could well be that as Bitcoin is tested in a high inflation, rising rate environment for the first time, investors are choosing tradition over a new frontier,” said Jeffrey Halley, senior market analyst at Oanda Asia-Pacific Pte.

“Gold has been an inflation hedge for millennia.”

In fact, the 50-day correlation between ‘new’ and ‘old’ gold is at its lowest since 2018 while the correlation between bitcoin and Nasdaq stocks has soared as ‘risk’ assets in general have suffered amid rising rates and increasingly hawkish central banks.

Of course, the last few years of massive global money printing has seen cryptos dramatically outperform every other asset class.

MicroStrategy founder Michael Saylor said in a recent Bloomberg Television interview that he can’t think of “anything better to position our company in an inflationary environment than to convert our balance sheet to Bitcoin.”

Nevertheless, while the short-term correlation between gold and crypto is significantly negative, over the medium-term they both are shouting the same message of dedollarization and a loss of faith in the global hegemon…

And maybe, just maybe, the soaring price of oil is also reflective to some degree of a weaker perspective on the dollar.