Source: Bonner Private Research

We were wow-ed by a chart sent to us on Sunday by our sidekick, and investment director, Tom Dyson. We’ve been exploring how the numbers used by the feds are mostly lies and misinformation. The statistics are monsters, with arms sewn on where there should be legs…and ghastly heads made of pig iron. The money itself – the post-1971 dollar – is phony and unreliable. The theories and formulas used by the feds are faulty, clumsy, and fraudulent. And now we see that the whole boom – from 1999 to 2022, which took the Dow from 10,000 to over 36,000 – was an imposter.

Let us say, you were a smart investor. In 1999, you wisely decided to invest your money alongside the richest, smartest investor the world has ever produced – Warren Buffett.

It was very easy to do. In effect, Buffett operates a kind of mutual fund. He puts the best companies he can find in it. And he charges no fees or commissions for taking part. You just buy his “fund” – Berkshire Hathaway.

Then, in the following 22 years – which, thanks to stunning tech breakthroughs and huge new capital inputs, as well as the enlightened guidance of the Fed, should have been the most productive and profitable years in human history – you keep your money in Berkshire.

Mr. Buffett realized long ago that the secret to long term capital growth is to reinvest the profits in more capital growth. Rather than paying dividends, which are taxed, the money is used to buy more good companies, thus increasing the capital value – the price of Berkshire stock.

So…you have the best investor in history, at the best time in history, with the best strategy ever devised. And no need to bother with the confusion wrought by dividends; there weren’t any.

What happened? Over the next 22 years, your investment went up, and up, and up. Buffett avoided the obvious pitfalls – the dot.coms…the mortgage finance dizzies…the crypto delusionals…and the tech dreams. No WeWork or Lyft for him. He stuck with good companies producing good profits, by providing good products and services to good customers.

Did his investors make money? Yes, they did.

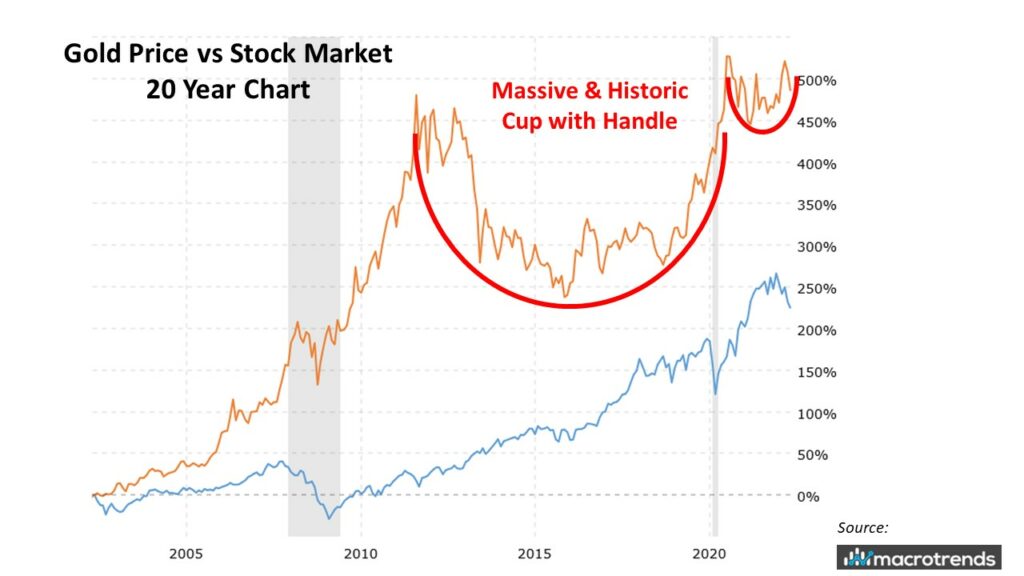

But wait. The chart sent over by Tom Dyson shows that if you quote the price of Berkshire shares in terms of real money – gold – rather than dollars, you find that you have made no money at all. An ounce of gold buys you the same number of Berkshire shares now as it did 23 years ago.

In other words, there was no American Tailwind…not in the 21st century. Not yet. It was all ‘misinformation.’ Buffett’s bet on American businesses didn’t really pay off. The investor would have done just as well to buy gold at the end of the 20th century and sit tight.

And what of the coming years? Will a stiff yankee doodle breeze begin to blow again? Will the qualities that made America such a success – balanced budgets, limited government, and a dollar you could trust – re-emerge? Or, will a combination of debt, inflation, corruption, fiscal fantasy, fraud and imperial overstretch doom the US to decades of misery?